Citigroup mistakenly credits $81 trillion to customer instead of $280

Robert Besser

04 Mar 2025, 11:57 GMT+10

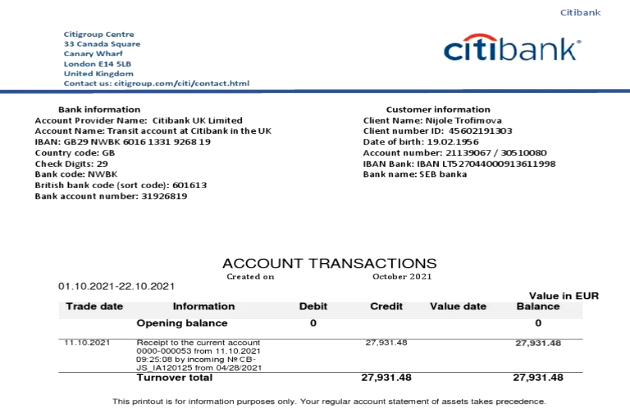

- A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280

- The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address

- According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280, according to a report by the Financial Times (FT) this week.

The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address.

According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day. A third employee finally caught the issue an hour and a half later, prompting the bank to reverse the incorrect credit several hours after it had been processed.

Citigroup disclosed the incident—which qualifies as a "near miss" because no funds were lost—to U.S. regulators, including the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

In response to inquiries, a Citi spokesperson told Reuters that the bank's "detective controls" quickly identified the ledger entry mistake and reversed it before it could impact the customer or the bank.

This isn't the first time Citigroup has faced scrutiny over its risk management systems. According to an internal report reviewed by the FT, Citigroup recorded 10 near misses of $1 billion or more in 2023, down slightly from 13 the previous year.

The bank has been under regulatory pressure to improve its internal controls. In 2020, Citi was fined $400 million for issues related to risk management and data governance, and in July 2023, it was fined an additional $136 million for failing to make sufficient progress in fixing those shortcomings.

Citigroup's Chief Financial Officer Mark Mason acknowledged last month that the bank is investing more in technology, data management, and compliance to strengthen its risk oversight.

"We saw the need to invest more in the transformation on data, on technology, on improving the quality of the information coming out of our regulatory reporting," Mason said.

Citigroup continues to strengthen its internal processes to reduce the frequency of such high-stakes errors. While the $81 trillion mistake was caught in time, it serves as a reminder of the risks associated with large-scale banking operations—and the importance of robust oversight mechanisms.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Haiti Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Haiti Sun.

More InformationInternational

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

Business

SectionLululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....